RPGT Exemptions tax relief Good news. Which year is the year of disposal for Thomas.

What We Need To Know About Rpgt

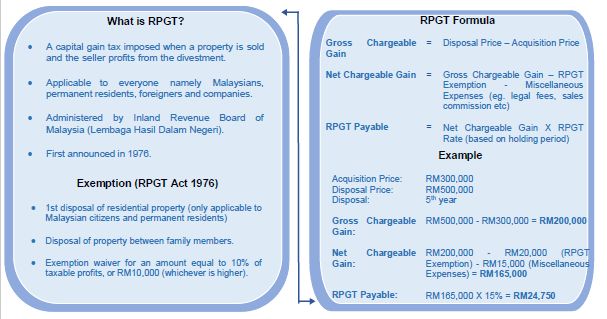

A real property gains tax rpgt applies to the sale of land in malaysia and.

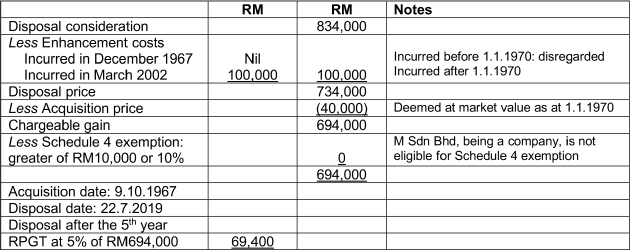

. Lets bring this to life with an example. With effect from 21101988 RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or other right in or over such land. Malaysia is a member of the british commonwealth and its tax.

Malaysia Dates of filing Returns Reporting and Payment. 20001 - 35000. There are some exemptions allowed for RPGT.

Miss As chargeable gain would be RM300000. 13 bi Created Date. The main factors that determine which RPGT rate apply to you are.

342000 RPGT rate 30 RPGT payable 102600 Acquisition Price AP of land PE of the from MAF 503 at Universiti Teknologi Mara. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Companies Trustee 1 Society 3 Individuals Individuals 2 and Executor of deceased estate 2 Companies 2 Within 3 years.

For example individual Malaysian citizen and partners. Except part II and part III. Part 1 Schedule 5 RPGT Act.

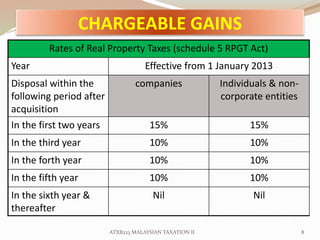

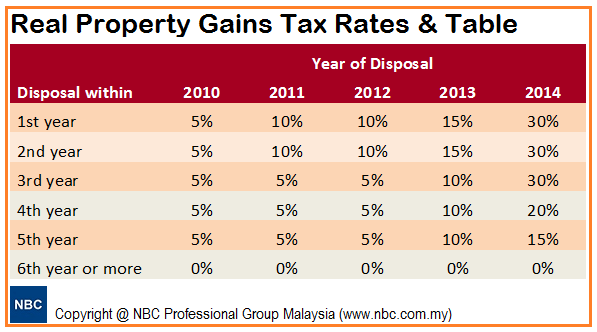

In the 6 th and subsequent years. REAL PROPERTY GAIN TAX 1976 RPGT 24 May 2017 Wednesday Venue. Since 2014 though RPGT rates have remained the same.

It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them. Further to the above on 1 st January 2018 the Finance No2 Act 2017 came into effect with amendments to the Real Property Gains Tax Act of 1976. How much RPGT do i have to pay.

This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016. Stamp duty is calculated on the market value of the property at the time of the acquisition whereas RPGT is calculated on the profit gained from the disposal of the property. Part II Schedule 5 RPGT Act.

If you owned the property for 12 years youll need to pay an RPGT of 5. RPGT rates Returns and assessment Date of disposal Withholding by acquirer Payment by disposer Exemptions Stamp Duty Basis of taxation Rates of duty Stamping Penalty. With effect from 1 January 2014 the.

In the 5 th year. Above RPGT Rates in Malaysia as of Budget 2014. Is not a malaysian citizen or permanent resident the rate of rpgt is 30.

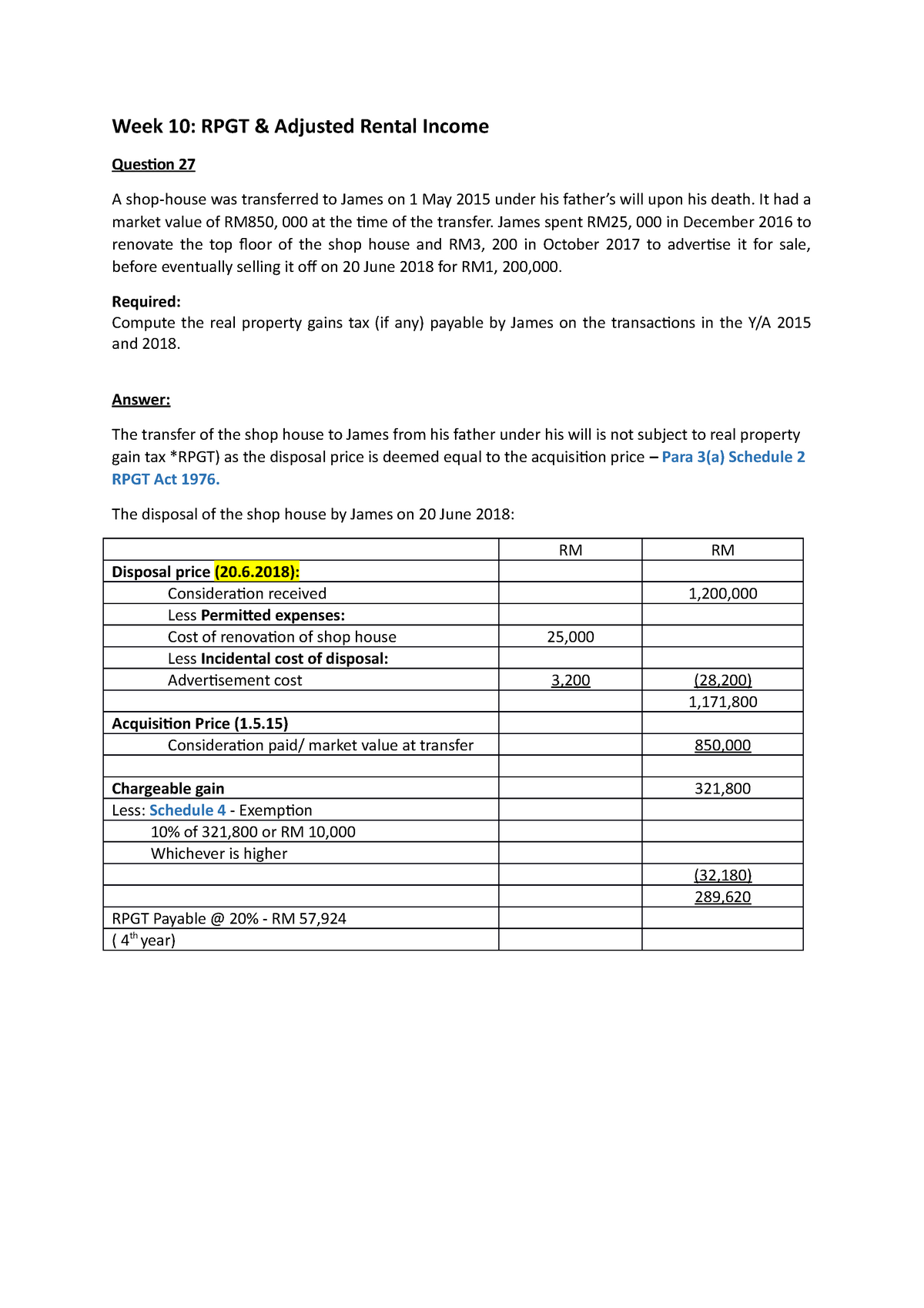

Miss A purchased a property for RM500000 three and a half years ago and sold it for RM800000. On the other hand if there is a failure to pay the RPGT within the timeframe given a 10 penalty will be imposed on the amount payable. April 10 2017 Generally an.

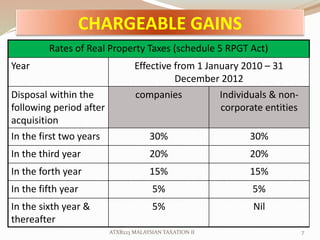

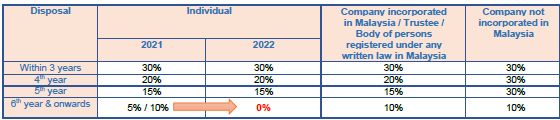

If you look at Real Property Gains Tax history in Malaysia the RPGT rates always change depend on the government policy etcUnder the recent Budget 2014 announcement the Malaysian Government has proposed a significant increase to the current RPGT rates to further curb speculative activities in the local real property market. The new amendment introduced a new subsection to the RPGT Act Section 21B 1A which increased the rate from 3 to 7 for a disposer who is not a citizen and not a permanent resident. RPGT rates in 2016 and 2017 As mentioned earlier the Government has tinkered around with RPGT rates a few times over the last decade or so largely in an effort to curb speculation and property flipping.

Where the disposer is a company the rpgt rate is 30 if the disposal takes. Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. In the 4 th year.

Youll pay the RPTG over the net chargeable gain. As such a sum of 7 instead of 3 of the total value of the consideration is to be retained by the acquirer if the disposer is not a Malaysian citizen or permanent resident. 5001 - 20000.

RPGT rates differs according to disposer categories and holding period of chargeable asset. Pursuant to the amendments it is worth noting that if you are a foreigner wishing to dispose of. These proposals will not become.

SW 3-6 Sunway College INTRODUCTION RPGT. For ya 2017 and 2018 the tax rate for companies and. How much RPGT Thomas has to pay.

Miss As RPGT RM300000 X RPGT Rate which is determined by. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550. In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years.

RPGT is charged on chargeable gain from disposal of chargeable asset such as houses commercial buildings farms and vacant land. 275000 - 103500 - 70005000 x 5 or 275000 - 168000 - 70005000 x 5 Thank you very much. Taxable Income RM 2016 Tax Rate 0 - 5000.

I believe it impacts a lot more on long-term property investors over short-term speculators who gain from flipping properties. RPGT would then be calculated by multiplying your chargeable gain with the relevant RPGT rate. All disposals made after such 5-year period are exempt from RPGT.

The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. So from tommorow onwards all property sold will be charged the new RPGT rate as stated in Budget 2019This is my scenario how much tax i have to pay if i were to sell my property next year. RGPT rate for 3rd Year 30 RPGT Payable selling price - buying price x RPGT Rate RM700000 - RM500000 x 30 RM200000 x 30.

Tax Year 1 January to 31 December Tax Return due date 30 April. View Sunway REAL PROPERTY GAIN TAX RPGTpptx from ACC 2054 at Sunway University College. Disposal in 6 th year and subsequent year.

How much RPGT Thomas has to pay.

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Understanding Rpgt Legally Malaysians

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Ppt Real Property Gain Tax Powerpoint Presentation Free Download Id 4503504

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Zerin Properties Real Property Gains Tax

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Taxation On Property Gain 2021 In Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Part 1 Acca Global

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

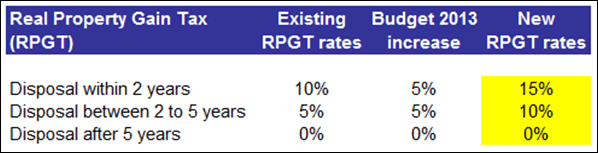

Budget 2013 Real Property Gain Tax Rpgt Increased To 15